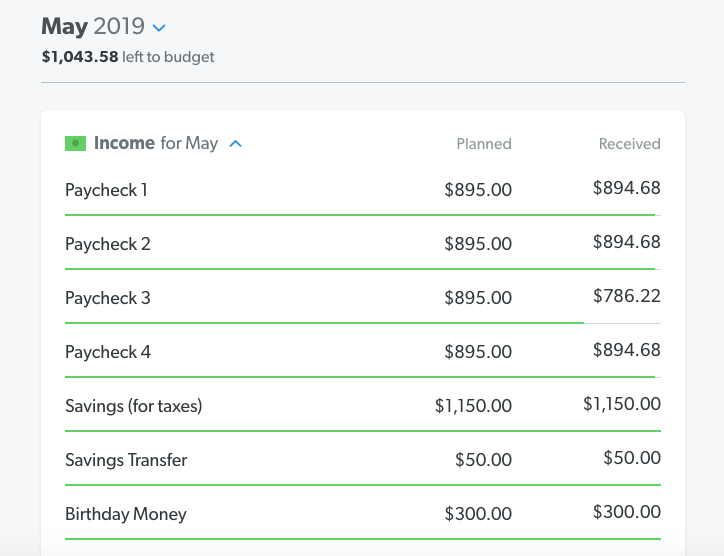

Below is a time block of how I budgeted during the time I paid off my student loans. I used the FREE budgeting software Everydollar. This was the most “on top of it” I had ever been with my money and it helped me reach my goal much faster. Here’s a typical month activity from May 2019.

Last week in April:

Logged into Everydollar and listed all the income that was coming my way for the month of May.

It was my birthday month so your girl was lit!

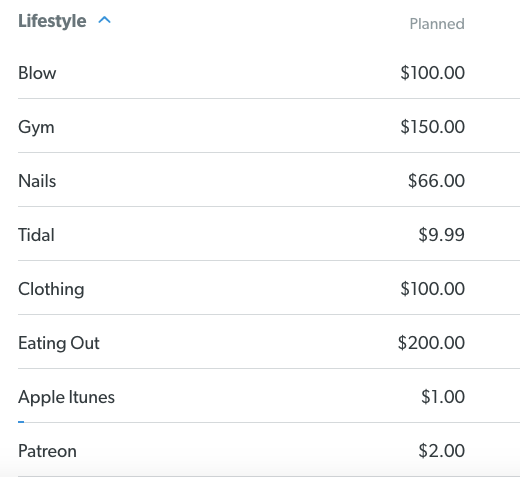

Then listed all my planned expenses for the month until there was no more left to budget for.

I should have increased my eating out budget since it was my birthday and there were probably going to be a lot of birthday dinners and get togethers.

2nd to Last Weekend in May:

Logged into my online bank and added each transaction for the month.

This was the hardest but most necessary part. It’s when I had to get real about what I did, but it’s also how I grew some discipline. If you need a lot of help, do this at the end of every week. When you get better, do it every two weeks. And when you feel like you mastered it, do it at the end of the month. (Everydollar also has a paid version that will sync to your bank account, its nice but not necessary as a single).

Last Weekend in May

Planned my budget for June, using the data from May.

So because I was so real with myself in May, it made me better for June. But I did have to make some decisions. Clearly I went over in the gym, but since that was important to me at the time, I increased my budget by $85 for June. I overspent in “Nails” but that was because I was feeling hype over my birthday and got an extra design. Next month I know to get a fill and ask for something more basic.